The City of Milton plans to reduce Property Taxes on its citizens for the 2021 fiscal year.

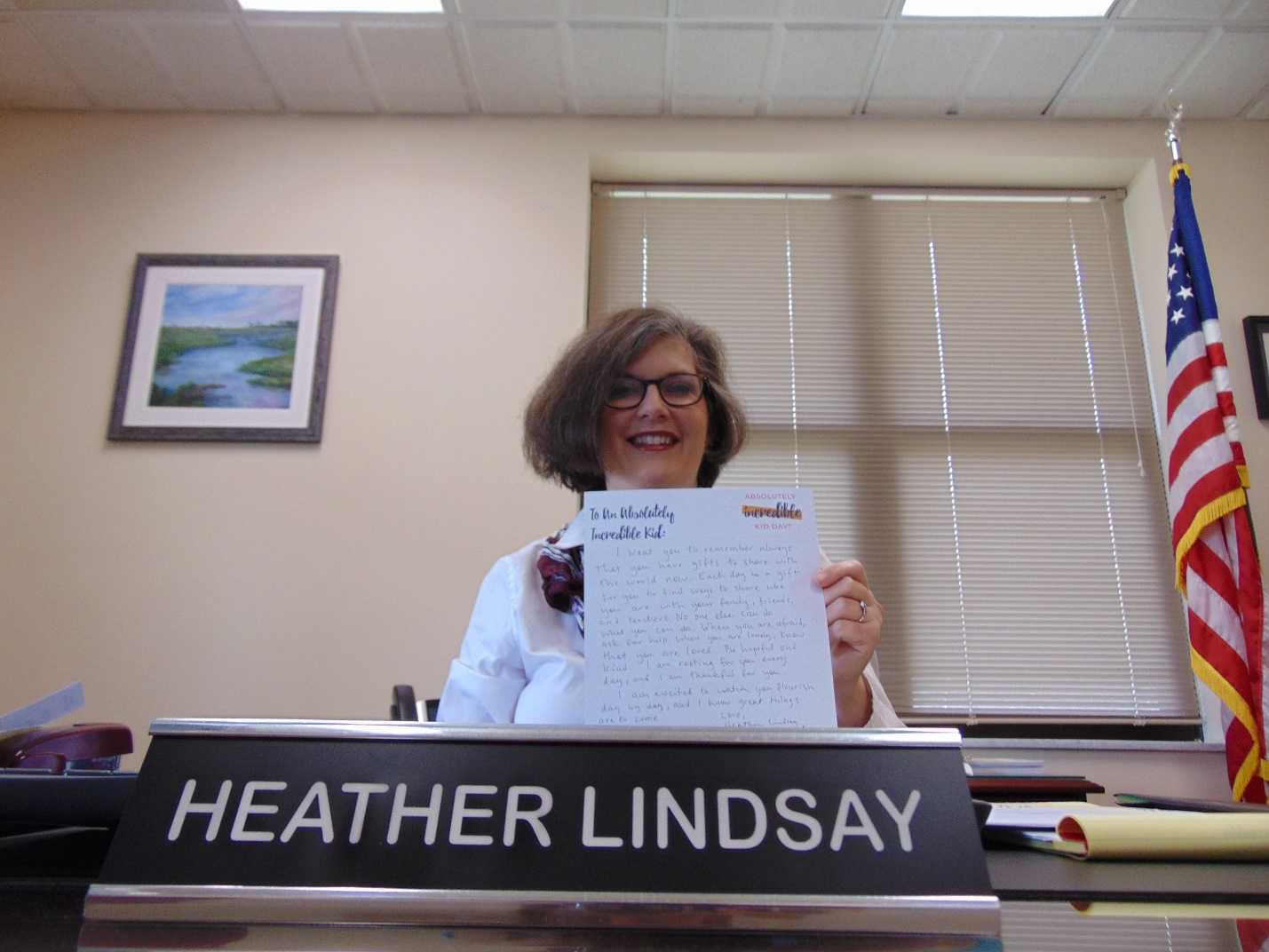

“We’re happy as a City that through good fiscal management we are able to proceed with a budget and a roll back rate that allows for a reduction in taxes,” said Mayor Heather Lindsay.

With the adoption of the Fiscal Year 2021 budget at the City Council meeting on September 22, 2020, Council approved a reduction in the millage rate for all City property owners. As a result, Miltonians may benefit from a tax decrease this coming year on the city portion of the ad valorem tax bill.

The new millage rate for property in the City is 3.0841%, down from 3.2373%, a 4.7% decrease.

The ad valorem taxes are calculated by multiplying the millage rate by every thousand dollars of taxable value, as determined by the Santa Rosa County Property Appraiser.

For example, a property with a taxable value of $50,000 would receive the following City ad valorem tax bill:

2020 City Ad Valorem Taxes: $50,000 X .0032373 = $161.87

2021 City Ad Valorem Taxes: $50,000 X .003841 = $154.21

This will provide a savings of $7.66 on a property valued at $50,000 on the upcoming tax bill.

For more information, please contact the City of Milton’s Budget Office at 850-983-5400.

Information on the City’s budget may also be found on the City’s website: www.miltonfl.org.

Calculation of Ad Valorem Taxes

There are two variables that make up the ad valorem taxes for a property. The first is the assessed value of the property. The assessed value is determined by the County Property Appraiser annually. As property appreciates or depreciates in value over time, the assessed value changes. The City has no control over the assessed value determination.

The second variable is the millage rate, or the amount of tax applied to the assessed value. A mill is 1/1000 of a dollar, or $1 of tax for every $1,000 of assessed value.

The millage can also be adjusted up or down annually by the various local government entities up to the maximum millage allowed by law.

The formula for determining the amount of ad valorem tax is:

Assessed Value X Millage Rate = Ad Valorem Tax

Both variables may change, up or down, annually, resulting in different taxes levied.