Last week it was discovered that a July 12 debate on Navarre incorporation proposals from two separate groups will not take place as planned. The moderator of that debate has since rescheduled a live debate, and he’s calling out Preserve Navarre for sharing false misinformation and presenting an “irresponsible” tax proposal.

Preserve Navarre Campaign Manager Robert Barnett via social media made a false assertion about Tony Hughes, who had been invited by the Greater Navarre Area Chamber to moderate the July 12 debate. Barnett claimed Hughes lives in Okaloosa County, but that is untrue. Hughes not only lives in Santa Rosa County but also owns a home in Navarre, meaning he would likely have to pay the 1 mill ad valorem assessment Preserve Navarre is proposing.

It’s not the first time a Preserve Navarre representative has made a false assertion. Nancy Forester, the group’s vice president, erroneously claimed that if Navarre incorporates it would automatically receive tourism tax revenue.

Hughes, who has 42 years experience in the banking industry, has since rescheduled the incorporation debate. Details for the new debate, which will be broadcast live via South Santa Rosa News’ Facebook page, will be announced soon. That event will feature Jonathan Cole, representing pro-incorporation, and a Navarre business leader, representing the anti-incorporation view. Hughes says he will ensure both the pro- and anti- sides stick to facts which are accurate.

In the meantime, Hughes went on to address Preserve Navarre’s tax proposal, which was shared via press release earlier today and suggested a 1 mill property tax rate.

“This latest ‘information release’ from Preserve Navarre shows how little Wes Siler and this group understands about how to finance local government,” said Hughes. “While no one likes paying taxes, the fact remains that we must have some form of local government, and it takes money to pay for schools, law enforcement, road and drainage infrastructure, etc.”

As part of its tax proposal, Preserve Navarre wants Santa Rosa County Commission to drop the current millage rate by 1 mill, but the group did not make suggestions on which services the county should cut to facilitate such a reduction.

“Basically all the things (Preserve Navarre) complains about that the county needs today, they’d propose cutting the funding for to pay for this tax cut,” Hughes said, pointing out that would result in a 16.4% decrease in county ad valorem tax revenue.”This is irresponsible and designed to take the sting out of the new taxes property owners and citizens in Navarre would have to pay in new city property taxes.”

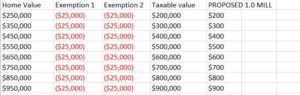

That 1 mill property tax collected by a future city would equate to $400 per year for a $450,000 home utilizing both $25,000 homestead exemptions. According to the Navarre Area Board of Realtors, the average recent home sale value in Navarre is around $436,000.

Additionally, Preserve Navarre did not provide any specific details regarding what services a future city would provide in exchange for collecting a 1 mill property tax from home owners within its proposed future city limits.

Opponents of incorporation suggest that a future city of Navarre would be a “pass-thru” government unable to offer much more service that the community already receives for 1 mill, considering that the mill rate of the county’s existing three municipalities are: 1.9723 for the City of Gulf Breeze, 2.99 for the City of Milton and 3.8 mills for the Town of Jay.

BACKGROUND ON LOCAL MILLAGE RATES

Currently the Santa Rosa County School Board has a mill rate of 5.9404. Northwest Florida Water Management District imposes a .0294 mill rate. Additionally, Holley-Navarre Fire District and Navarre Beach Fire Rescue also levy their assessment, including commerical properties.

Santa Rosa County Commission’s millage rate dropped from 6.6175 mils in 2006 to 6.0953 in 2008 and has not been raised back since then. During 2008 the county collected roughly $58 million in ad valorem, or property tax revenue.

“With the millage rate staying constant and property values declining, ad valorem revenues bottomed out in 2013 at roughly $44 million annually,” Hughes pointed out. “In fact, if you track the lost revenue annually from 2008 until 2019, which was the year annual ad valorem revenues finally matched what had been collected in 2008, Santa Rosa County was behind in revenue collection to the tune of $98 million.”

Hughes says that $98 million would have funded a lot of new roads, new drainage, more public safety and law enforcement equipment, better salaries for county deputies and more.

District 3 Commissioner James Calkins says he’s attempted to roll back the millage rate in the past. However, he did not receive a second on his motion. He went on to say that the board has a need to address infrastruture issues which went unaddressed as far back as The Great Recession. “We are trying to catch up on these important needs like storm water and road projects,” he said.