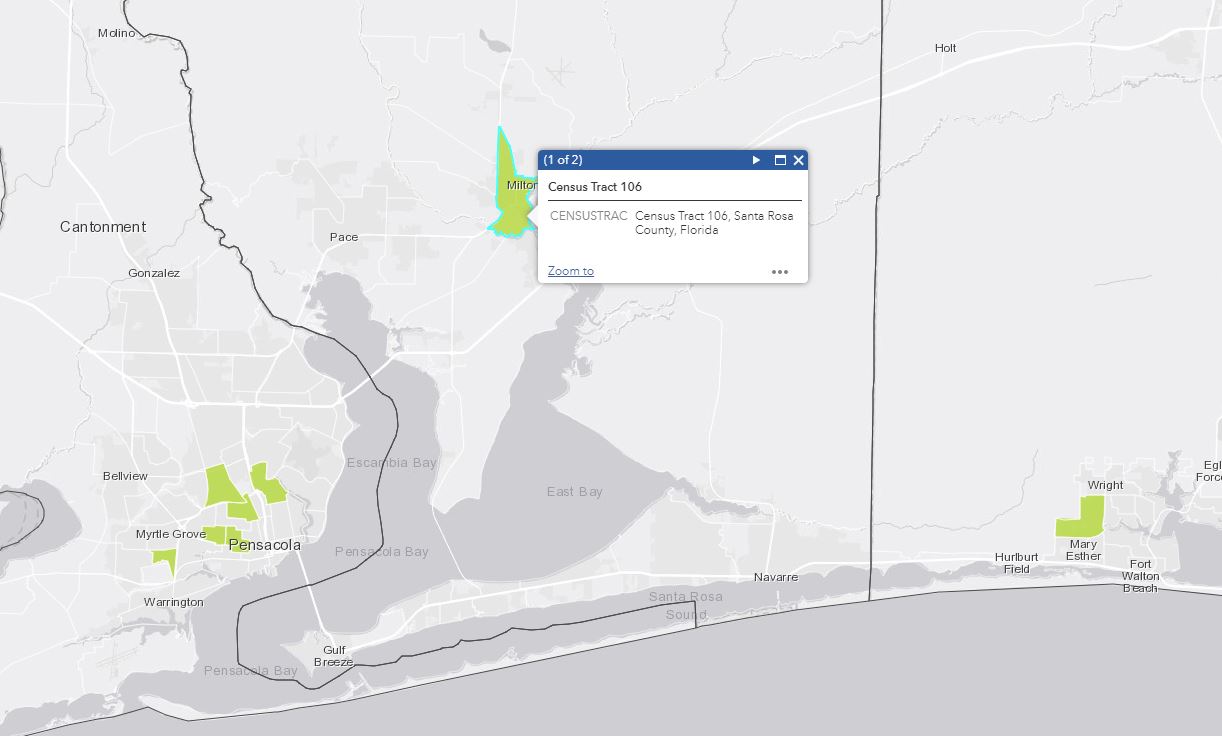

Florida Governor Rick Scott on Thursday announced that nine census tract areas in Escambia, Santa Rosa and Okaloosa Counties were part of 427 communities he recommended to be designed as Low Tax Opportunity Zones. Milton’s census tract 106 is the sole area slated for Santa Rosa County.

Low Tax Opportunity Zones, as established in the federal Tax Cut and Jobs Act of 2017, encourage long-term investment and job creation in targeted communities by reducing taxes for many job creators. Low Tax Opportunity Zones enhance local communities’ ability to attract businesses, developers and financial institutions to invest in targeted areas by allowing investors to defer capital gains taxes through investments in federally established Opportunity Funds.

“I am proud to put forth my recommendations for 427 communities across every county in Florida to be designated as Low Tax Opportunity Zones. These Zones will make a real and lasting difference in some of our highest-need areas by helping to bring new capital investment and more jobs to every county across the state. They will also bring additional investment to rural communities and urban areas, ensuring that every Floridian has the chance to live the American Dream in the Sunshine State,” Scottt stated.

Cissy Proctor, Executive Director of the Florida Department of Economic Opportunity, said, “The new Opportunity Zone program will bring the chance for growth home to hundreds of communities from the Panhandle to the Keys. This program will help capitalize on economic development that is already underway and provide a new tool in the toolbox for communities that are looking to grow their economy.”

The evaluation process included statistical analysis of poverty rates, population, unemployment rates and other economic indicators, along with assessing recommendations from more than 1,200 requests. These specific requests came from municipal and county governments, regional planning councils, nonprofits, developers, investors and more.

The U.S. Department of the Treasury has 30 days to certify each state’s recommendations. After the Zones are approved, the federal government will begin the rulemaking process to designate how Opportunity Funds are created and how businesses, developers and financial institutions can invest in qualified Zones.

“In the four years before I took office, Florida lost more than 800,000 jobs, taxes increased by more than $2 billion, debt was skyrocketing and the economy was in ruins. When I became Governor, I promised the families of our state that I would spend every day fighting to grow Florida’s economy, and over the past seven years, we have seen firsthand the huge success that comes with creating an environment where business can grow and create opportunities. Today, thanks to our hard work to cut taxes and reduce burdensome regulations, Florida businesses have created nearly 1.5 million private-sector jobs and unemployment has dropped in every Florida county – but our work isn’t over. Florida must continue to maximize every opportunity to keep growing our booming economy and ensure every family can succeed in our state,” Scott stated.